College Planning Consultants

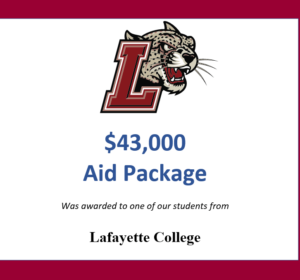

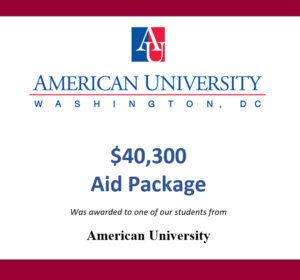

Ecliptic Financial Advisors is a practice dedicated to helping you find the most affordable way to maximize and fund your child’s college education. As one of the top college funding practices in the country – and one of the largest in New Jersey – our firm has deep roots and experience in the financial services industry.

Schedule a free consultation to join the thousands of students we have helped save on college tuition and expenses.

Our team of advisors specialize in college admissions counseling, college funding consulting, and college planning workshops. Ecliptic Financial Advisors has 30+ years of experience and expertise navigating clients through the college planning process.

JOIN US FOR OUR NEXT WEBINAR OR LIVE WORKSHOP

Sign up for our free college planning webinar or live workshop to get your questions answered and learn how to beat the high costs of college.

Expert Advisors to Help You With College Financial Aid, Admissions and Planning

Our services are designed to help families navigate through the college admissions and financial aid processes. Our team is dedicated to helping you find the most affordable way to fund and plan your child’s college education.

COLLEGE ADMISSIONS COUNSELING

Premier college admissions counseling and application assistance services for ambitious students.

COLLEGE FUNDING CONSULTING

Strategies to maximize savings and fund your tuition. Navigate the financial burdens and expenses of a college education.

COLLEGE PLANNING WORKSHOPS

Attend our free college planning workshops to gain valuable information on college funding, admissions, and the application process.

Calculate your Student Aid Index for free by using our SAI calculator. This tool will help you better understand your potential savings for college tuition and expenses.

Ecliptic Financial Advisors is considered unique among retirement planners as we offer solutions for families who are planning for both retirement and their child’s education at the same time

READY TO GET STARTED?

Navigate the college admissions and planning process with the comfort and expertise of Ecliptic Financial Advisors. Fill out the free non-obligatory form to request more information!